- TradedVC

- Posts

- $2.3B Cursor Series D • $2B Thinking Machines Raise • Gopuff Secures $250M Growth Round • Kalshi Cuts Coinbase Custody Deal • Orion Lands $6M Seed To Scale AI Security

$2.3B Cursor Series D • $2B Thinking Machines Raise • Gopuff Secures $250M Growth Round • Kalshi Cuts Coinbase Custody Deal • Orion Lands $6M Seed To Scale AI Security

AI infra, agent tools, and prediction markets dominated the week with mega rounds, strategic partnerships, and high velocity commercial integrations across enterprise and consumer networks.

Your dose of daily dealflow, essential VC & tech trends to know. The biggest moves in venture, all in one place. Celebrating startups, founders, and funders.

🧑🍳 Let’s get right into it…

💻 Cursor locked in a massive $2.3B Series D, fueling an AI-native coding stack backed by Accel, Coatue, and a16z.

🧠 Thinking Machines Lab pulled $2B to accelerate frontier-model research with support from Nvidia, AMD, Cisco, and Accel.

🚚 Gopuff grabbed $250M to expand instant commerce as Valor and Eldridge double down on the category.

🔐 Kalshi teamed up with Coinbase in a high-leverage custody deal bringing USDC rails to the CFTC-regulated prediction exchange.

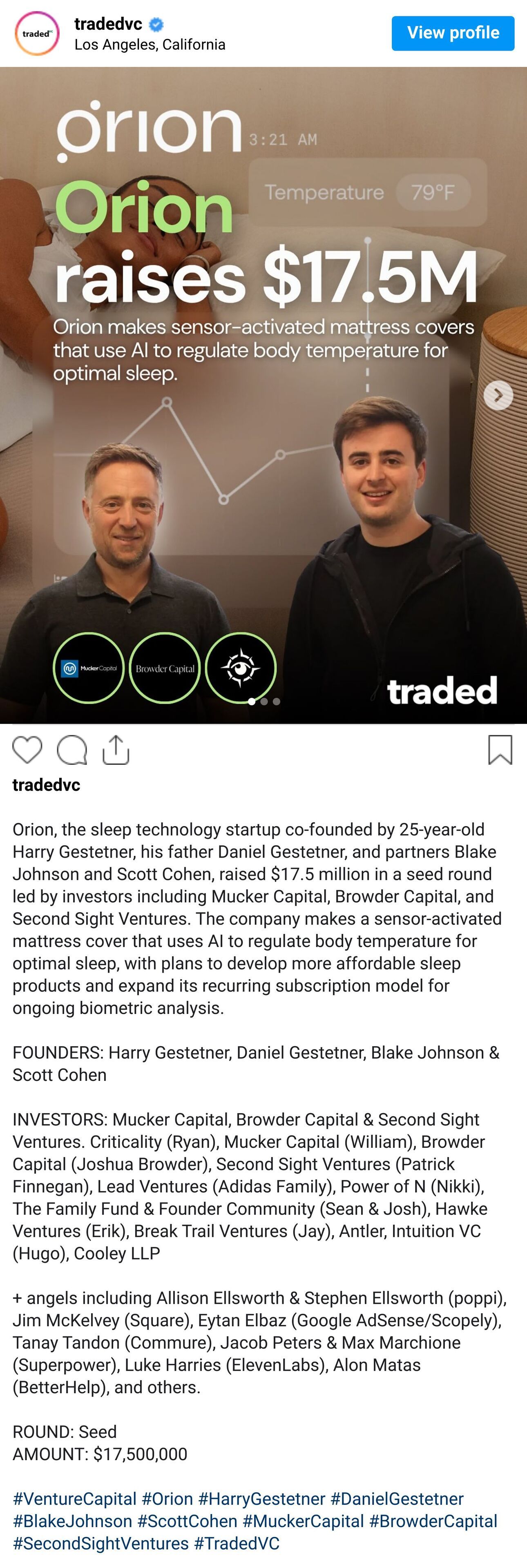

🛌 Orion secured $17.5M Seed to scale its AI-powered sleep-tech platform, including its sensor-activated mattress cover and biometric insights.

🏭 Harbinger raised $160M Series C to ramp electric truck manufacturing with backing from FedEx and Capricorn.

🧑🚀 Top Deals You Can’t Miss

1️⃣ Thinking Machines Lab – $2B raise powering a new frontier AI research lab backed by a16z, Nvidia, AMD, Cisco, and Accel.

2️⃣ Cursor – $2.3B Series D fueling its ultra-fast AI coding and software development platform.

3️⃣ Gopuff – $250M growth round extending its lead in rapid commerce with backing from Eldridge, Valor Equity, and Baillie Gifford.

4️⃣ Kalshi – Strategic partnership with Coinbase, bringing USDC custody and payouts on-chain for the CFTC-regulated event exchange.

5️⃣ Orion – $17.5M Seed to scale its AI-powered sleep-tech platform, including its sensor-activated mattress cover and biometric-analysis subscription model.

🧠 Dopamine Dealflow

🌳 Series B+ & Growth

Thinking Machines Lab, a San Francisco–based artificial intelligence research and product company, raised $2,000 million in Seed funding. Andreessen Horowitz led the round and was joined by Nvidia, AMD, Cisco, Accel, Jane Street, and other investors.

Cursor, a San Francisco–based AI coding and development platform, raised $2,300 million in Series D funding. Accel and Coatue led the round and were joined by Thrive Capital, Andreessen Horowitz, DST Global, Nvidia, and Google.

Gopuff, a Philadelphia–based instant commerce and rapid delivery platform, raised $250 million in growth funding. Eldridge Industries and Valor Equity Partners led the round and were joined by Baillie Gifford, Equalis Capital, Robinhood, George Ruan, Yakir Gabay, and the company’s cofounders.

Harbinger, a Los Angeles–based electric truck manufacturer, raised $160 million in Series C funding. FedEx, Thor Industries, and Capricorn’s Technology Impact Fund led the round and were joined by Leitmotif, Tiger Global, Maniv Mobility, and Schematic Ventures.

Alembic Technologies, a Bay Area–based AI marketing analytics platform, raised $145 million in Series B funding. Prysm Capital and Accenture led the round and were joined by WndrCo and SLW Ventures.

Sweet Security, a Tel Aviv–based runtime CNAPP and AI security platform, raised $75 million in Series B funding. Evolution Equity Partners led the round and were joined by Munich Re Ventures, Glilot Capital Partners, and Key1 Capital.

GC AI, a Bay Area–based AI legal workspace, raised $60 million in Series B funding. Scale Venture Partners led the round and were joined by Northzone, ICONIQ Growth, Accel, Mangrove Capital Partners, and Sequoia Capital.

Tavus, a San Francisco–based AI human computing company, raised $40 million in Series B funding. CRV led the round and were joined by Scale Venture Partners, Sequoia Capital, Y Combinator, HubSpot Ventures, and Flex Capital.

🚀 Series A

Parallel Web Systems, a Palo Alto–based AI-native web infrastructure company, raised $100 million in Series A funding. Kleiner Perkins and Index Ventures led the round and were joined by Khosla Ventures and other existing backers.

Exowatt, a Miami–based renewable energy company powering AI data centers with dispatchable solar, raised $50 million in additional Series A funding. MVP Ventures and 8090 Industries led the round and were joined by Felicis, The Florida Opportunity Fund, DeepWork Capital, Dragon Global, Massive VC, Atomic, and other investors.

WisdomAI, a San Francisco–based AI data analytics platform, raised $50 million in Series A funding. Kleiner Perkins led the round and were joined by NVentures, Coatue, Latitude Capital, Madrona, GTM Capital, Menlo Ventures, and U First Capital.

Vend Park, a Boston–based parking operations and monetization platform, raised $17.5 million in Series A funding. Blue Heron Capital led the round and was joined by Nuveen Real Asset Ventures, Communitas Capital, and other investors.

Endolith, a Denver–based biomining startup using AI-guided microbes to unlock new copper supply, raised $13.5 million in Series A funding. Squadra Ventures led the round and were joined by Draper Associates, Collaborative Fund, Overture Climate Fund, and other investors.

🌱 Seed & Early Rounds

Milestone, an Israel–based platform that measures ROI from generative AI coding tools, raised $10 million in Seed funding. Heavybit and Hanaco Ventures led the round and were joined by Atlassian Ventures and multiple angels.

Self, a San Francisco–based zero-knowledge identity and proof-of-humanity platform, raised $9 million in Seed funding. Greenfield Capital led the round and were joined by SoftBank’s Startup Capital Ventures x SBI Fund, Spearhead VC, Verda Ventures, Fireweed Ventures, and several angels.

Bindwell, a San Francisco–based agtech company using AI to accelerate pesticide discovery, raised $6 million in Seed funding. General Catalyst and A Capital led the round and were joined by SV Angel and Paul Graham.

Confidein, a Los Angeles–based AI and faith-tech company, raised $6 million in Seed funding. A syndicate of Christian leaders and venture capital firms led the round and were joined by additional faith-aligned investors.

Orion, a Tel Aviv–based AI-powered data protection platform, raised $6 million in Seed funding. Pico Partners and FXP led the round and were joined by Underscore VC and multiple cybersecurity leaders.

Estate Media, a Los Angeles–based real estate entertainment media company, raised $1 million in Seed funding. Jam Fund led the round with participation from strategic real estate and media investors.

🤝 Strategic, M&A & Undisclosed

Kalshi, a CFTC-regulated event contracts exchange, entered a strategic partnership with Coinbase, where Coinbase Custody will manage all USDC deposits and payouts for the exchange.

Polymarket, a New York–based prediction market platform, signed an exclusive multi-year partnership with UFC and Zuffa Boxing to integrate prediction markets across live events and digital channels.

NICE, a Hoboken–based customer experience software company, agreed to acquire Cognigy, a Düsseldorf-based conversational and agentic AI platform, in a $955 million all-cash deal. The company’s existing institutional shareholders joined the transaction.

💸 VC Funds Raised & Raising

J2 Ventures, a Boston–based dual-use technology fund, raised $250 million for its Brookhaven Fund from institutional and strategic LPs including the New Mexico State Investment Council.

Park Rangers Capital, a New York–based early-stage venture fund backing “baby elephant” software startups, raised $4.3 million for its debut fund from over 130 founders, operators, and family offices.

Founders: Want to be featured on @tradedvc? → traded.co/submit/vc

@tradedvc posts on 🔥

📚 Read of the Day

🔮 Kalshi Partners with Coinbase to Scale Regulated Prediction Markets

What Happened

Kalshi partnered with Coinbase to use Coinbase Custody for all USDC deposits and payouts on the only federally regulated event markets exchange in the United States. This strengthens Kalshi’s financial infrastructure and expands Coinbase’s institutional footprint.

The Strategy

Kalshi is building a deeper market for real-world event trading. Coinbase enables compliant money movement and institutional-grade custody that supports higher volume and more market categories.

Why It Matters

Event markets are becoming a new derivatives class. Kalshi gains scale and trust through Coinbase while Coinbase accelerates USDC as core settlement infrastructure.

📰 News You Don’t Want To Miss

🤖 Productivity App Hero Launches SDK That Autocompletes AI Prompts

The SDK improves prompt quality, which reduces iteration cycles for AI powered apps.

🏭 Microsoft Builds AI Super Factory in Atlanta to Power OpenAI and xAI

The new site doubles Microsoft’s data center footprint with GPU dense architecture for frontier AI workloads.

🎮 Valve Reveals 3 New Hardware Devices for the Steam Ecosystem

The new lineup positions Valve for a major return to hardware in 2026.

📱 Google Will Let Experienced Users Keep Sideloading Android Apps

Google updated its policy to preserve sideloading for advanced users while tightening verification elsewhere.

✏️ OpenAI says it’s fixed ChatGPT’s em dash problem — OpenAI now allows users to instruct ChatGPT to avoid using the em-dash punctuation, a subtle yet common giveaway of AI-written text.

OVER AND OUT, BACK TO THE GRIND ⚙️

Want more content? We don’t blame you. You can find more TradedVC content on Instagram, LinkedIn, X, and at traded.co/vc✌️