- TradedVC

- Posts

- $6.5B SoftBank Ampere Buyout • Databricks In Talks For Up To $5B At $134B Valuation • $300M Black Forest Labs Series B At $3.25B • $120M Harmonic Raise For Mathematical Superintelligence • Nvidia Puts $2B Into Synopsys • Black Friday Online Spend Hits Record $11.8B

$6.5B SoftBank Ampere Buyout • Databricks In Talks For Up To $5B At $134B Valuation • $300M Black Forest Labs Series B At $3.25B • $120M Harmonic Raise For Mathematical Superintelligence • Nvidia Puts $2B Into Synopsys • Black Friday Online Spend Hits Record $11.8B

AI infrastructure and visual intelligence pull in the biggest checks while strategic chip deals tighten the stack, as consumers quietly set a new Black Friday spending record and the Thanksgiving cold chain shows where real pricing power lives.

Your dose of daily dealflow, essential VC & tech trends to know. The biggest moves in venture, all in one place. Celebrating startups, founders, and funders.

🧑🍳 Let’s get right into it…

🤖 SoftBank Group is buying Ampere Computing for $6.5B, locking up Arm-based AI data center silicon just as hyperscalers look beyond x86 for their next wave of compute.

📊 Databricks is reportedly in talks to raise up to $5B at a $134B valuation, keeping the AI data and infra race very much alive in late-stage private markets.

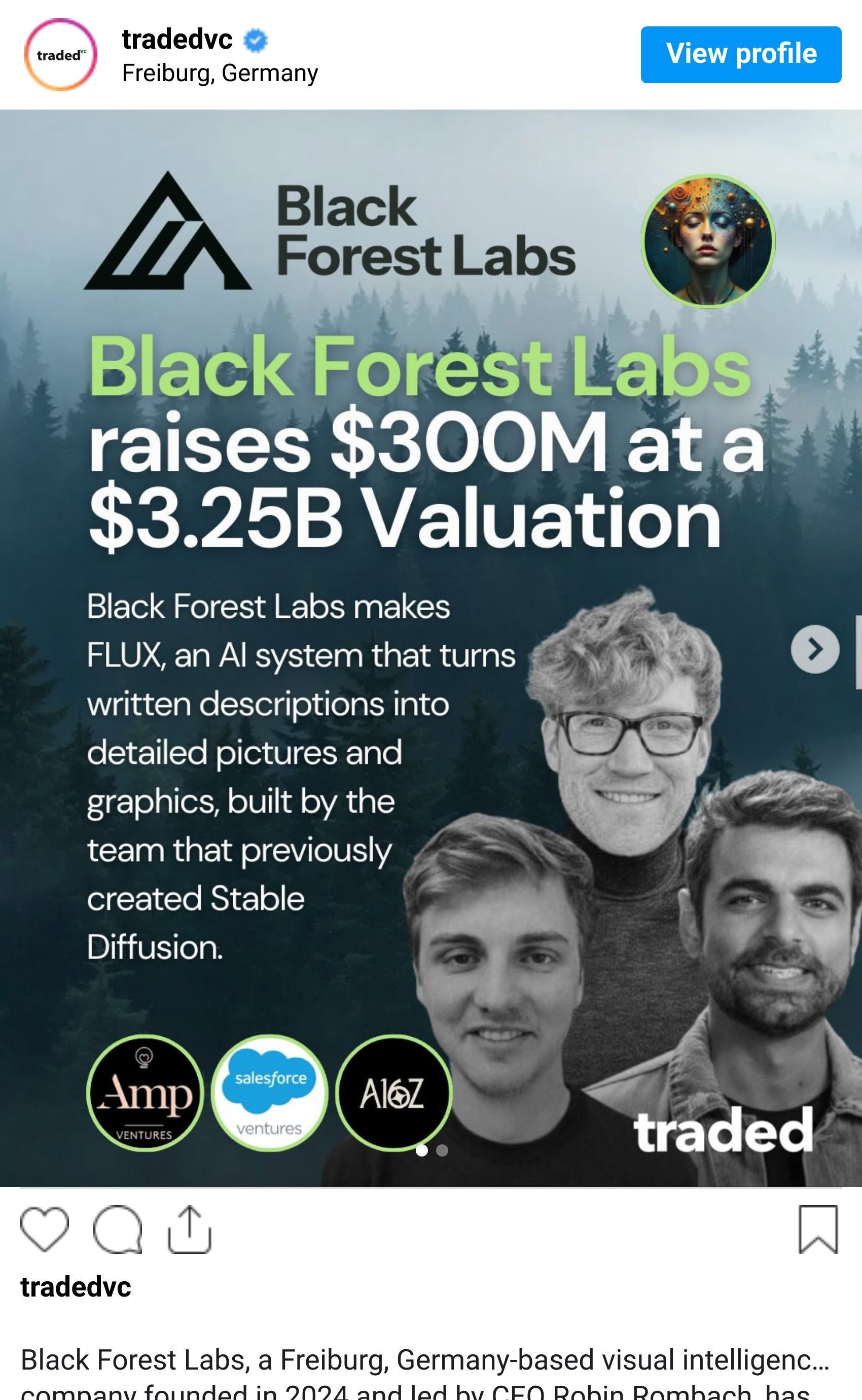

🎨 Black Forest Labs banked a $300M Series B at a $3.25B valuation to scale its FLUX visual intelligence models for enterprise and creative workflows.

💻 Nvidia is putting $2B into Synopsys stock as part of an expanded AI tools partnership, tightening the link between chip design software and GPU demand.

🛍️ U.S. consumers spent a record $11.8B online on Black Friday, with AI-powered deal discovery and recommendations helping push conversion to new highs.

🦃 Lineage Logistics is quietly running the frozen turkey cold chain for roughly 46M birds, turning peak Thanksgiving demand into serious infrastructure leverage.

🧑🚀 Top Deals You Can’t Miss

1️⃣ SoftBank Group – $6.5B acquisition of Ampere Computing, bringing Arm-based data center chips in-house as the group positions for the next phase of AI infrastructure demand.

2️⃣ Nvidia – $2B strategic equity investment in Synopsys, deepening a multi-year partnership around AI-powered chip design tools and locking in more of the semiconductor value chain.

3️⃣ Black Forest Labs – $300M Series B at a $3.25B valuation, giving its FLUX visual intelligence models fresh firepower in the race to own premium image generation and editing.

🧠 Dopamine Dealflow

🌳 Series B+ & Growth

Black Forest Labs, a Freiburg, Germany-based visual intelligence company behind the FLUX image-generation models, raised $300M in Series B funding at a $3.25B valuation. AMP and Salesforce Ventures led, joined by a16z, Nvidia, Northzone, Creandum, Earlybird, General Catalyst, and others.

Harmonic, a Palo Alto, CA-based AI lab developing mathematical superintelligence, raised $120M in Series C funding at a $1.45B valuation. Ribbit Capital led alongside Sequoia, KP, Emerson Collective.

Sokin, a London, UK-based cross-border treasury and payments platform, raised $50M in Series B funding. Prysm Capital led with Morgan Stanley Expansion Capital and angels including former PayPal execs.

Overstory, an Amsterdam-based vegetation intelligence platform for utilities, raised $43M in Series B funding led by Blume Equity.

Xposure Music, a Montreal-based tech-driven financing platform for independent artists, raised $42.5M across debt and equity.

Perelel, an LA-based OB/GYN-formulated women’s health supplement brand, raised $27M in growth funding led by Prelude Growth Partners.

Gravis Robotics, a Zurich-based earthmoving autonomy platform, raised $23M in funding led by IQ Capital and Zacua Ventures.

Evidium, a San Francisco-based healthcare AI company, raised $22M in funding co-led by Health2047 and WGG Partners.

Clover Security, a Tel Aviv-based product security company, raised $36M across Seed + Series A rounds led by Notable Capital and Team8.

Zetagen Therapeutics, a NYC-based clinical-stage biopharma company, raised $12M+ in Series B1 funding.

EcoG, a Munich-based B2B EV charging company, raised €16M in funding.

Vijil, a Menlo Park-based AI agent company, raised $17M in funding.

Codenotary, a Houston-based AI cybersecurity and software supply-chain trust company, raised $16.5M.

Protego Biopharma, a San Diego-based clinical-stage biotech, raised $130M in Series B funding.

Robotera, a Beijing-based embodied intelligence company, raised RMB 1B in Series A+ funding.

MiCare Path, a Memphis-based virtual care company, raised an undisclosed growth round.

Lighthouse Learning Group, a Mumbai-based education services provider, raised an undisclosed growth round from KKR and PSP Investments.

🚀 Series A

Clover Security, Tel Aviv — $36M across Seed + A (consumer security angle).

Evidium, San Francisco — $22M Series A (added above; appears once).

Find Your Grind, Los Angeles — $5M Series A for Gen Z career and lifestyle discovery, led by Echo Investment Capital.

Augmentt, Ottawa — CAD $18M Series A for MSP Microsoft 365 security.

Enerin, Norway — €15M Series A for high-temperature industrial heat pumps.

Rencore, Munich — $15M Series A extension for cloud governance tools.

Onlayer, Türkiye — $8.2M Series A for regtech and merchant management.

Mznil, Saudi Arabia — $11.7M Series A for labor housing proptech.

HelloBoss, Tokyo — Undisclosed Series A for AI-powered recruitment.

🌱 Seed & Early Rounds

CoPlane, San Francisco — $14M Seed for AI-native back-office automation.

Procure AI, London — $13M Seed for automated procurement workflows.

Bhub, São Paulo — $10M Seed for AI-driven accounting for entrepreneurs.

Onton, San Francisco — $7.5M Seed for AI product search and discovery.

Lumia, Boston — $7M+ funding for smart biometric earrings.

Crux, McLean — $6.5M Pre-Seed for pharma benefits platform.

Strataphy, Saudi Arabia — $6M Seed for cooling AI & industrial infra.

Juo, Warsaw — $4.6M Seed for product subscription management.

SubImage, San Francisco — $4.2M Seed for cloud security graph infra.

Marble Imaging, Bremen — €5.3M Seed for big-data EO.

Adcities, Madrid — €3M+ Seed for adtech.

Anyformat, Madrid — €3.3M Seed for document AI.

Social Links, Netherlands — $3M funding for AI risk solutions.

TISC, San Francisco — $2.1M Pre-Seed for intelligent retrieval.

Gosta Labs, Helsinki — €7.5M Seed for healthtech.

Ranketta, Czech Republic — €1M Pre-Seed for AI visibility analytics.

SENO, China — $700K Pre-Seed for thin-film delivery systems.

LabelBlind Solutions, Mumbai — $500K Seed for AI food labelling.

The Home Equity Partners, Toronto — undisclosed financing.

Indicio, Seattle — undisclosed funding from NEC X.

🤝 Strategic, M&A & Undisclosed

SoftBank Group acquired Ampere Computing for $6.5B.

Paxos acquired Fordefi, an institutional crypto custody platform.

Gloo (Nasdaq: GLOO) acquired XRI Global, a multilingual voice AI company.

Xoriant acquired TestDevLab, a software quality engineering firm.

Cegid acquired Shine, a Copenhagen-based SMB fintech.

Synopsys received a $2B strategic investment from Nvidia as part of an expanded AI tools partnership.

OpenAI took an equity stake in Thrive Holdings as part of a strategic capital alignment.

💸 VC Funds Raised & Raising

Sterling Investment Partners V — $1.6B for business services & distribution.

Jolt Capital Fund V — €600M (~$650M) first close toward €1.1B target.

Future Energy Ventures Fund II — €235M for energy-tech.

India Global Forum Fund — $250M for Indian consumer & industrial brands.

VL Fund (Victor Lazarte) — $200M debut AI-focused venture fund.

Chui Ventures Fund I — $17.3M for pan-African seed investing.

Founders: Want to be featured on @tradedvc? → traded.co/submit/vc

🦃 Thanksgiving Power Players

🦃 Butterball controls roughly 1 in every 3–4 turkeys sold in the U.S., making it the dominant supplier during holiday demand.

🛒 Walmart & Kroger lead pre-Thanksgiving grocery traffic, with Walmart often hitting its annual peak this week, while Costco spikes on bulk frozen turkey runs.

🤖 Afresh, an AI-powered grocery optimization startup, feeds demand forecasting and real-time inventory data into major retailers, shaping availability and pricing during peak Instacart weeks.

🍗 Product Spotlight: What Everyone’s Buying

🔪 HexClad, the hybrid stainless-steel + nonstick cookware brand, is now among Amazon’s top five best-selling cookware sets heading into Thanksgiving. Viral turkey-searing videos and Gordon Ramsay’s partnership (he calls the hybrid tech “absolute perfection”) have turned HexClad into the season’s go-to premium upgrade for home cooks.

@tradedvc posts on 🔥

📚 Read of the Day

🧊 The Startup Keeping America’s Frozen Turkeys Moving

Inside the cold chain moving tens of millions of birds before Thanksgiving

Opening:

Americans eat 46M turkeys on Thanksgiving, most spending weeks in a tightly choreographed frozen supply chain run by Lineage Logistics, the world’s largest cold storage operator. With the turkey flock at a 40-year low and wholesale prices up 40%, cold chain reliability is strategic.

The Product Pitch:

Operates 480+ temp-controlled facilities across 19+ countries, connecting farms, processors, and retailers.

Sensors track every load; software reroutes shipments instantly to avoid storms, labor shortages, or spoilage events.

The Backstory:

Founded in 2008, Lineage expanded through 100+ acquisitions, built the Lineage Link cloud platform, and raised $1.9B during the pandemic before going public. Alongside Americold, it controls most third-party U.S. cold storage capacity.

Why It Matters:

Pricing power: freezer fees have surged from $20 → $50 per pallet in peak season.

Beyond Thanksgiving: ~90% of Thanksgiving turkeys are frozen, and the same infrastructure underpins pharma, produce, seafood, and global food security.

📰 News You Don’t Want To Miss

🤖 OpenAI leak confirms ads are coming to ChatGPT — Internal builds show sponsored answer slots and carousel-style ad formats coming to ChatGPT.

🚗 Tesla launches “Tesla Ride” real-world demos for FSD + Grok AI — 45-minute supervised sessions give riders hands-on experience with FSD Supervised and Grok-powered in-car intelligence.

🛍️ Black Friday hits record $11.8B in U.S. online spend — Up ~9% YoY, driven by AI recommendation engines and retailer-native agents.

OVER AND OUT, BACK TO THE GRIND ⚙️

Want more content? We don’t blame you. You can find more TradedVC content on Instagram, LinkedIn, X, and at traded.co/vc✌️