- TradedVC

- Posts

- Anduril hauls $2.5B, Scale AI eyes $10B+, and VC funds stack $2B for the next wave of AI & infra

Anduril hauls $2.5B, Scale AI eyes $10B+, and VC funds stack $2B for the next wave of AI & infra

Oh, and also, Omada Health debuts on Nasdaq at a $1.28B valuation, Mindset Ventures launches a global music‐tech fund, and digital‐health IPOs are staging a comeback.

Your dose of daily dealflow, essential VC & tech trends to know. The biggest moves in venture, all in one place. Celebrating startups, founders, and funders.

👋 Let’s get right into it…

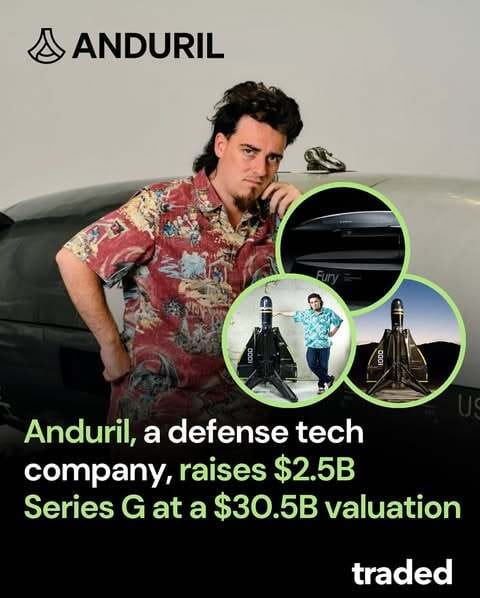

Anduril just banked a massive $2.5B Series G, doubling its valuation to $30.5B and staking its claim as defense-tech’s undisputed juggernaut. Scale AI is quietly lining up a $10B+ round, with Meta at the table: positioning itself as the enterprise AI infra king.

On the dev side, Infisical raised $16M to protect secrets, while Impart Security and Latent Technology scored rounds to push AI deeper into security and gaming physics.

VCs aren’t slowing down: Amplify dropped $900M across three new funds (including one for digital bio), and Europe’s Lakestar is gunning for $300M in defense-tech bets.

Infra, AI, and deeptech are eating the week. Let’s go.

Billions are flying. Let’s break it down.

🧠 Dopamine Dealflow

Believ (London, UK) – Raised £300M (equity + debt), backed by Liberty Global, Zouk Capital, Santander, ABN Amro, NatWest, and MUFG, to roll out 30,000+ EV charging stations across the UK.

Mosanna Therapeutics (Basel, Switzerland) – Raised $80M Series A, led by Pivotal bioVenture Partners and EQT Life Sciences, to commercialize a nasal spray for sleep apnea.

Guardz (Tel Aviv, Israel) – Raised $56M Series B, with backing from ClearSky, SentinelOne, Hanaco Ventures, and others, to scale its AI-first cybersecurity platform for SMBs.

Beewise (Oakland, CA / Israel) – Raised $50M Series D, led by Fortissimo and Insight Partners, to build robotic hives that tackle the global pollination crisis.

Definely (London, UK) – Raised $30M Series B, led by Revaia with Alumni Ventures and Clio, to simplify legal drafting with AI-powered tools.

Turnkey (San Francisco, CA) – Raised $30M Series B, led by Bain Capital Crypto, to grow its crypto wallet infrastructure, co-founded by ex-Coinbase engineers.

Nooks (Arlington, VA) – Raised $25M Series A, backed by Lockheed Martin, SAIC, Zigg Capital, to redefine classified workspaces via CIaaS.

Ballers (New York, NY) – Raised $20M Series A, led by Sharp Alpha and RHC Group, to build sports-meets-hospitality venues backed by Andre Agassi and David Blitzer.

Kargo (San Francisco, CA) – Raised $18.4M, led by Matter Venture Partners, with Founders Fund and Lineage, to scale its AI-driven logistics ops.

Altura (Amsterdam, Netherlands) – Raised €8M Series A, led by Octopus Ventures, for its AI-native bid management platform.

Hirundo (Tel Aviv, Israel) – Raised $8M Seed, led by Maverick Ventures Israel, to pioneer "machine unlearning" and reduce AI bias.

GyanDhan (New Delhi, India) – Raised INR 50 Cr, led by Classplus and Pravega Ventures, to grow its education financing network.

Apis Point Energy (Boston, MA) – Raised $4.2M Series A, led by Merrin Investors, to help fuel distributors hedge price risk.

Nova Talent (Madrid, Spain) – Raised €3.2M, backed by CDP Venture Capital and BY Venture Partners, to scale its invite-only professional network.

Shilo (Tempe, AZ) – Raised $2.6M Seed, led by AZ-VC, to launch an AI assistant built for real estate pros.

Modii Inc. (Dallas, TX) – Raised Undisclosed Seed, led by EVP, to modernize mobility and parking via cloud-based SaaS.

Remynt (San Francisco, CA) – Received Undisclosed Investment from One Washington Financial to grow its credit recovery and financial wellness platform.

💸 VC Funds Raised & Raising

Amplify Partners raised $900M across three new funds, including its first-ever fund focused exclusively on digital bio startups.

Banner Capital closed a $400M continuation fund backed by Hamilton Lane, rolling eight portfolio companies into the vehicle.

Banner Capital also launched its second middle-market buyout fund with a target of $200M, focusing on lower-mid-market growth plays.

Lakestar is targeting $250M–$300M for its first European defense tech fund, tapping into the continent's national security wave.

Swen Capital Partners raised $182M for its impact VC fund aimed at ocean biodiversity and regenerative marine ventures.

Founders: Want to be featured on @tradedvc? → traded.co/submit/vc

@tradedvc posts on 🔥

OVER AND OUT, BACK TO THE GRIND ⚙️

Want more content? We don’t blame you. You can find more TradedVC content on Instagram, LinkedIn, X, and at traded.co/vc✌️