- TradedVC

- Posts

- Google–Wiz Deal Clears U.S. Regulators ($32B) • Google Partners With Kalshi for Prediction Data • $400M Perplexity–Snap Partnership • $80M Reevo AI Round • $50M Inception Diffusion Bet • $16M Evotrex Hybrid RV Launch

Google–Wiz Deal Clears U.S. Regulators ($32B) • Google Partners With Kalshi for Prediction Data • $400M Perplexity–Snap Partnership • $80M Reevo AI Round • $50M Inception Diffusion Bet • $16M Evotrex Hybrid RV Launch

Google expands its data and AI footprint as regulators clear its $32B Wiz deal. Venture capital keeps buzzing across AI, crypto, and sustainable mobility.

Your dose of daily dealflow, essential VC & tech trends to know. The biggest moves in venture, all in one place. Celebrating startups, founders, and funders.

🧑🍳 Let’s get right into it…

📊 Google partners with Kalshi to bring real-time prediction-market data to Google Finance and Search.

☁️ Google receives U.S. government approval for its $32B acquisition of Wiz, expected to close in 2026 and strengthen its cloud-security presence.

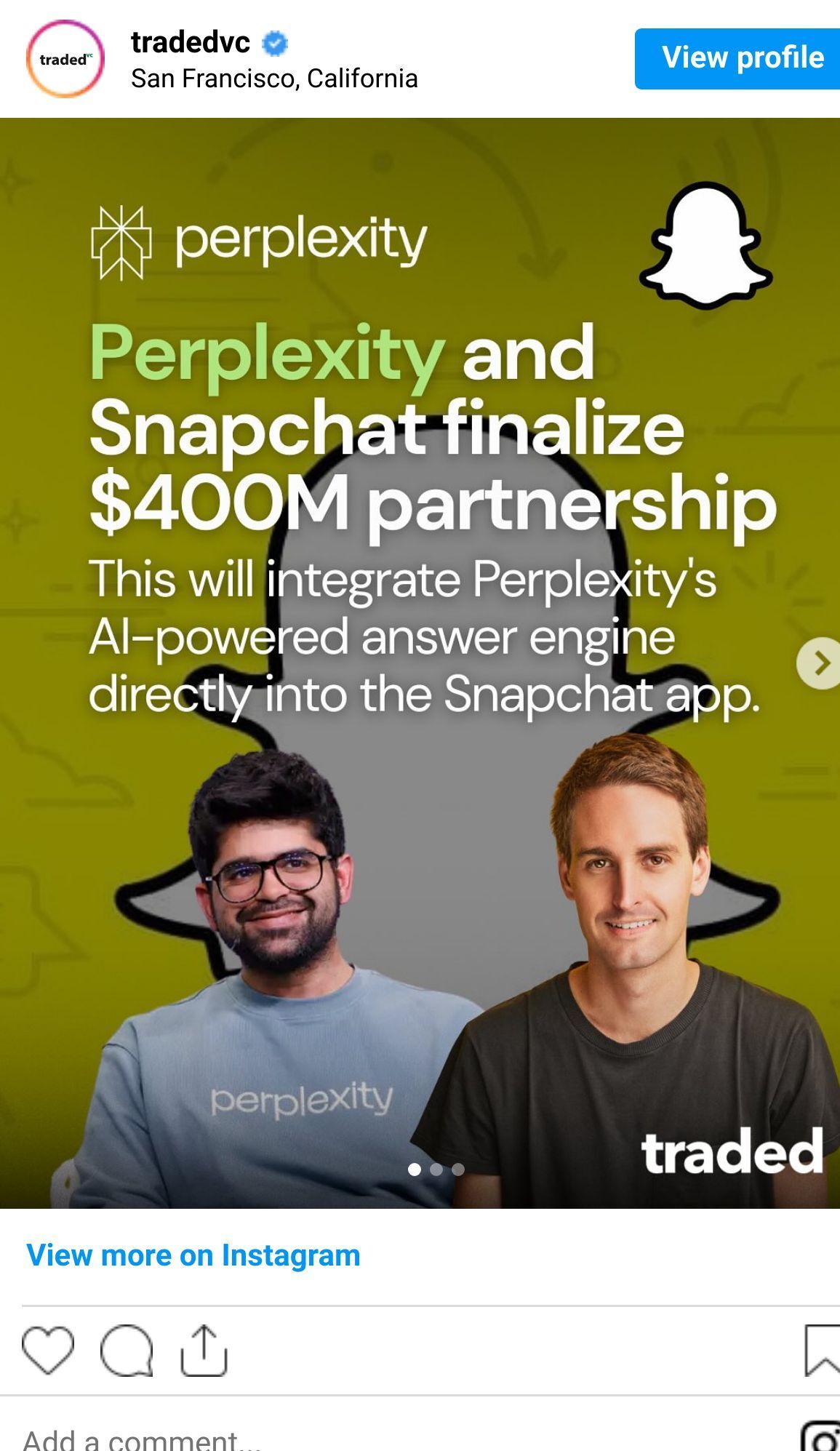

💬 Perplexity AI signs a $400M deal with Snap to bring AI-powered search to Snapchat.

🚐 Evotrex, an Anker-backed hybrid RV startup, emerges from stealth with $16M Pre-A funding to reinvent sustainable travel.

🧩 Reevo raises $80M to unify fragmented go-to-market stacks into one AI-native platform.

🧠 Inception secures $50M to build diffusion models for code and text.

🧑🚀 Top Deals You Can’t Miss

1️⃣ Google × Kalshi – Partnership to integrate prediction-market data into Google Finance and Search, bringing market probabilities to billions of users.

2️⃣ Perplexity AI × Snap – $400M partnership integrating AI search into social.

3️⃣ Evotrex – $16M Pre-A raise for an Anker-backed hybrid RV redefining off-grid mobility.

🧠 Dopamine Dealflow

🌳 Series B+ & Growth

Google, Mountain View, CA-based tech giant, received U.S. government approval for its $32B acquisition of Wiz, a cloud-security company expected to close in early 2026.

Armis, a San Francisco-based cyber exposure management company, raised $435M in pre-IPO funding at a $6.1B valuation.

Braveheart Bio, a San Francisco-based biotech developing therapeutics for hypertrophic cardiomyopathy, raised $185M Series A.

AAVantgarde Bio, a Milan, Italy-based biotech developing therapies for inherited retinal diseases, raised $141M Series B.

MoEngage, a Bengaluru and San Francisco-based customer engagement platform, raised $100M in growth funding.

Reevo, a Santa Clara, CA-based AI-native GTM platform, raised $80M in funding.

Neok Bio, a Palo Alto, CA-based biotech developing ADCs for cancer, raised $75M Series A.

Upway, a Paris, France-based refurbished e-bike leader, raised $60M Series C.

Inception, a Palo Alto, CA-based diffusion-model startup for code and text, raised $50M led by Menlo Ventures with participation from Mayfield, Innovation Endeavors, Microsoft M12, Snowflake Ventures, Databricks Investments, and NVIDIA Ventures.

Procurement Sciences, a Washington, DC-based AI platform for government contracting, raised $30M Series B.

DualBird, a Boston, MA-based data infrastructure startup, raised $25M across Seed and Series A rounds.

🚀 Series A

🌱 Seed & Early Rounds

Wabi, a San Francisco-based “YouTube for apps” startup from the Replika founder, raised $20M Pre-Seed led by Khosla Ventures.

Cactus, a San Francisco-based AI copilot for home services, raised $7M Seed.

CommanderAI, a Los Angeles-based sales platform for waste haulers, raised $5M Seed.

Mindsmith, a Provo, UT-based AI-native e-learning platform, raised $4.1M Seed.

GitLaw, a San Francisco-based AI legal services provider, raised $3M Pre-Seed.

Rilevera, a New Jersey-based cyber detection management startup, raised $3M Seed.

Boostie, a Lafayette, CO-based automated talent marketing platform, raised $500K Seed.

Evotrex, a California-based hybrid RV startup backed by Anker, raised $16M Pre-A.

arcoris bio, a Schlieren, Switzerland-based diagnostics company, raised CHF 6.3M Seed.

Freeda, a Paris, France-based AI construction-plan analysis startup, raised €3.4M Seed.

🤝 Strategic, M&A & Undisclosed

Perplexity AI, an AI search company, signed a $400M cash and equity deal with Snap to power AI search in Snapchat.

Google × Kalshi, a U.S.-based data partnership bringing prediction-market probabilities into Google Finance and Search.

NetVendor, a Tualatin, OR-based vendor compliance software provider, received a majority investment from Five Arrows.

Billd, an Austin, TX-based financial platform for subcontractors, received a strategic investment.

Klaim, a U.S.-based healthcare payments company, received an investment from Claritev Corporation (NYSE: CTEV).

Precision Neuroscience, a NYC-based brain-computer interface company, received an investment from SCI Ventures.

SOC Prime, a Boston-based AI-native detection intelligence platform, received a strategic investment.

Creekstone Energy, a Salt Lake City-based energy-infrastructure company for AI computing, raised an undisclosed Series B.

💸 VC Funds Raised & Raising

Teleo Capital Management, a Boise, ID-based PE firm, closed Teleo Capital II at $350M.

Forbion, a Naarden, Netherlands-based life sciences VC, closed Forbion BioEconomy Fund I at €200M.

CMT Digital, a Chicago-based blockchain VC, closed its fourth fund at $136M.

Rubio Impact Ventures, an Amsterdam-based impact VC, closed its third fund at €70M.

MVP Ventures, a San Francisco-based early-stage VC, reported Fund II at 1.45× TVPI, placing it in the top 5% of its vintage.

Founders: Want to be featured on @tradedvc? → traded.co/submit/vc

📚 Read of the Day

Google Brings Prediction-Market Data to Search

Kalshi becomes the first regulated prediction-market platform integrated into Google Finance.

Google announced plans to display live probabilities from Kalshi directly in Google Finance and Search, giving users access to market-based odds for elections, economic data, and crypto events. The integration marks Google’s first step into prediction-based analytics.

The Strategy: By adding Kalshi’s data feed, Google is testing whether real-money market probabilities can complement traditional finance indicators.

Why It Matters: This partnership brings regulated prediction-market data to a global audience, merging fintech and search insights for institutional and retail users alike.

📰 News You Don’t Want To Miss

☁️ Google Gets US Approval to Acquire Wiz for $32 Billion — Regulators approve the deal, paving the way for a 2026 close.

📊 Google to Offer Kalshi Data on Finance Searches — Google will surface real-time prediction-market probabilities from Kalshi in Search and Finance.

🚐 Anker-Backed Hybrid RV Startup Evotrex Comes Out of Stealth — Evotrex debuts a power-generating hybrid RV for off-grid travel.

💬 Perplexity to Pay Snap $400M to Power Search in Snapchat — Snap adds Perplexity’s AI-powered search tech to its app.

❤️ Tinder to Use AI to Get to Know Users, Tap Into Camera Roll Photos — Tinder’s new “Chemistry” feature learns from users’ photos and interests.

🚲 Peloton Recalls 833K Bikes Amid Safety Concerns — The CPSC urged owners to stop using affected models and contact Peloton for replacements.

OVER AND OUT, BACK TO THE GRIND ⚙️

Want more content? We don’t blame you. You can find more TradedVC content on Instagram, LinkedIn, X, and at traded.co/vc✌️